Money Maven India: India's Premier Financial Educational Game

Welcome to the comprehensive encyclopedia guide for Money Maven India – one of the most popular and impactful financial educational games in India. Designed to make learning about money management, investing, and personal finance engaging and accessible, Money Maven India has revolutionized how Indians approach financial literacy. Whether you are a student, a working professional, or someone looking to improve their financial skills, Money Maven India offers a unique blend of education and entertainment that caters to all age groups and financial knowledge levels.

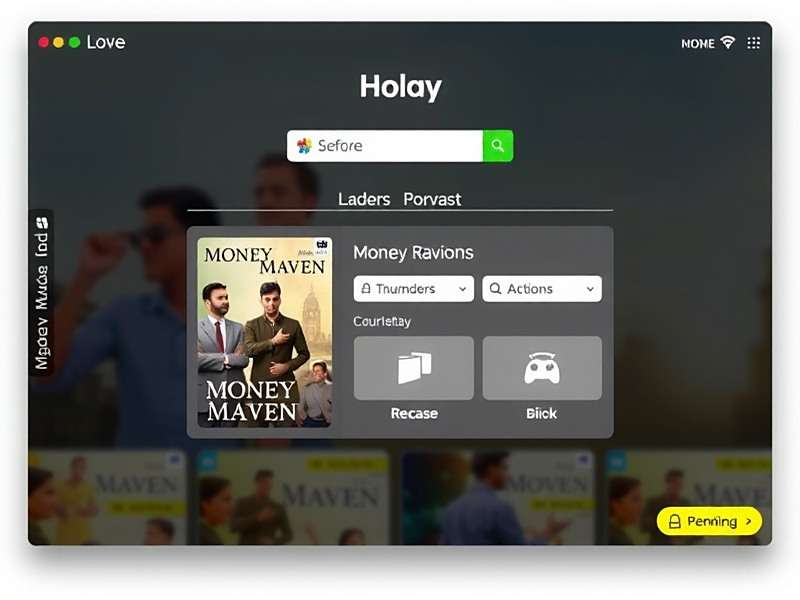

Figure 1: The home screen of Money Maven India, showcasing its user-friendly interface and key features.

In this encyclopedia entry, we will delve deep into every aspect of Money Maven India, including its core concept, gameplay mechanics, download statistics across India, player reviews and ratings, localization adaptations for different regions of India, exclusive player 攻略, upcoming local events, and the vibrant community that surrounds the game. We will also provide essential information on how to download and log in to Money Maven India, ensuring that you have all the resources you need to start your financial learning journey with the game.

1. Overview of Money Maven India

1.1 Core Concept and Purpose

Money Maven India was developed with a clear mission: to address the gap in financial literacy among Indians. According to recent surveys, a large percentage of the Indian population lacks basic knowledge of financial concepts such as budgeting, saving, investing in mutual funds, understanding insurance, and managing debt. Money Maven India aims to bridge this gap by turning complex financial topics into interactive gameplay that is both fun and educational.

The game follows a role-playing format where players take on the role of a "Money Maven" – an individual who navigates through various life stages (from student life to retirement) while making financial decisions. Each decision in the game has real-world consequences, helping players understand how their choices impact their financial health. Whether it’s choosing between saving for a vacation or investing in a fixed deposit, or deciding whether to buy term insurance or a unit-linked insurance plan (ULIP), Money Maven India provides a safe environment for players to learn from their mistakes without any real financial risk.

Figure 2: Players can select their "Money Maven" character, each representing a different life stage and financial background.

1.2 Key Features of Money Maven India

Money Maven India stands out from other financial apps and games due to its unique set of features that combine education with entertainment. Some of the key features include:

- Life Stage Simulation: Players progress through different life stages (Student, Young Professional, Married with Kids, Pre-Retirement, Retirement) and face financial challenges specific to each stage. This helps in understanding long-term financial planning.

- Realistic Financial Scenarios: The game includes scenarios that are relatable to Indians, such as dealing with medical emergencies, planning for a child’s education, buying a house in a metro city like Mumbai or Delhi, and investing in Indian financial instruments (mutual funds, stocks, PPF, NPS).

- Interactive Quizzes and Challenges: To reinforce learning, Money Maven India offers daily quizzes and challenges on topics like GST, income tax, banking products, and more. Players earn rewards for correct answers, which can be used to unlock new features in the game.

- Personalized Financial Reports: After completing each level or life stage, players receive a detailed financial report that analyzes their decisions, highlights areas of improvement, and provides tips for better financial management in real life.